Monetization Strategies for Mobile Games: What Works Best in the Canadian Market?

The mobile-gaming sector continues to dominate digital-entertainment platforms, and in Canada, a growing community of gamers and developers have emerged. With the global mobile-gaming revenue crossing above $90 billion annually, Canadian game developers are increasingly keeping abreast of effective monetization strategies that allow them to turn gameplay activities into viable business models. But which monetization models actually work best in the Canadian market? Let’s go over some of the major ones, how they're doing locally, and exactly what makes them so good.

1. Freemium Model: The Most Popular Choice

The freemium model, one where the game is free to play but extra features are charged for, is a much-preferred way to monetize in Canada. Canadian gamers have a preference for low-risk entry, something the freemium model gives them. Usually, the developer markets IAPs for cosmetic upgrades, in-game currency, or speedier advancement so players can opt not to purchase anything unless they find value in it.

In Canadian favorites such as Clash Royale and Subway Surfers, freemium essentially means the perfect blend: addictive gameplay paired with well-thought-out upgrade mechanics. The recipe for success with the freemium method is to provide a balanced experience so that free users can enjoy themselves while those who pay feel the purchase was worthwhile.

2. In-App Advertising: Great for Mass Engagement

In-app advertising (IAA) is now primarily a main income stream for casual and hyper-casual games, which attract a large user base and often have a poor conversion rate for in-app purchases (IAPs). Rewarded video ads, banner ads, and interstitial ads are some of the popular formats found well-suited for the Canadian market.

Rewarded ads, in particular, are compelling since they provide the player with a "real" benefit: an extra life, some in-game currency, etc., in exchange for viewing a brief video. It is a non-invasive way of increasing engagement and revenue but also preserving the users' experience. Still, if ads are shown excessively, they can lead to churn, so it will be necessary to walk the fine line while implementing them.

3. Subscription Models: Predictable and Scalable

Subscription monetization is taking very strong roots in Canada, especially with customers who seek premium content and an ad-free experience. Games like Apple Arcade have promoted the idea of paying monthly for a curated and uninterrupted gaming experience in Canada.

Mobile games with constant updates and evolving content-lay along the lines of RPGs or simulation games-are best suited for such monetization models. This keeps developers from having sometimes irregular income while players enjoy added bonus features or early drops.

4. Paid Games: Niche but Valuable

Although most mobile game players in Canada are fans of free games, there remains a niche market willing to pay for high-quality, ad-free games upfront. The model is best suited for story-driven games, indie games, and those with a strong brand base.

The Canadian market has consistently been interested in paying games that focus on premium design and no in-game spending. Success with this model, though, relies greatly on review, marketing, and first user impression. The paid model is not as scalable as freemium or advertising models but can earn a great deal of revenue with the proper target demographic.

5. Hybrid Monetization: Best of All Worlds

One of the best monetization strategies in the Canadian mobile gaming market is a hybrid model—mixing IAPs, ads, and subscriptions. This model enables developers to generate the most revenue by appealing to various user tastes. Non-paying players can earn money through ads, while paying players can get extra features or subscribe for benefits.

Massive hits such as Candy Crush Saga and PUBG Mobile employ a combination of monetization models to tap into revenue from every segment of players. Hybrid models perform especially well in the Canadian market because the nation has a diverse player base with different spending patterns.

6. Localization and Player Psychology

The Canadian audience must be understood in order to effectively monetize. Canadians are sensitive to transparency and more willing to embrace ethical monetization practices. Pushy methods such as paywalls or overspending on ads can result in bad reviews and user churn. Rather, providing tangible value, personalization, and respecting player time have been effective.

Localized pricing, culturally appropriate promotions, and national holiday or hockey event integrations can increase further engagement and in-game expenditure. Leveraging local culture, developers can build a more immersive and engaging experience.

7. Data-Driven Optimization

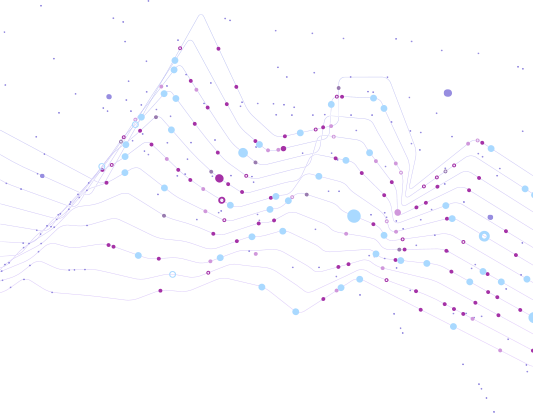

Monetization tactics must be optimized constantly by analyzing player data. Canadian game developers increasingly use analytics tools to analyze player behavior, retention rates, and in-app purchase funnels. This identifies drop-off points, successful ad placements, and possible upsell opportunities.

With A/B testing, user segmentation, and tracking engagement, monetization efficiency can be greatly enhanced in the long run to enable developers to customize their approach to the Canadian market.

Conclusion

The Canadian mobile gaming market is a profitable destination for developers if they get the monetization strategy right. Whether freemium, in-app ads, subscription, or hybrid, success is all about creating a fantastic player experience and multiple, value-based payment options. Getting to know local behavior, not being intrusive with monetization, and using data for optimization will make your game not just do well—but succeed in the competitive Canadian market.